Fair. Transparent. No Hidden Costs.

These Are Your ellexx invest Fees

Our Flat Fee: 0.42 – 0.59% Per Year

What’s Included in the Flat Fee

Your own secure Swiss account

Your money is held with our partner, Hypothekarbank Lenzburg AG – regulated by the Swiss Financial Market Supervisory Authority (FINMA). All your assets are safely stored in your personal custody account. Account and custody management are fully covered by the flat fee. With other providers, these fees often amount to several hundred francs per year, even for small portfolios.

Your rhythm, no trading fees

Whether you invest monthly or once a year: with ellexx, you pay no additional trading fees for purchases. It matters to us that investing is worthwhile even with small amounts – and that you benefit from investing regularly over the long term. And even if you choose to invest just once, you’ll never face an inactivity fee with us.

No golden chains

Even if you stop your savings plan or sell your ETFs, you won’t incur any additional costs for selling or cancellation fees – unlike with other providers.

Your money, your values

In our investment universe, you’ll only find ETFs that meet the ellexx investment principles. Our savings plans are curated by women, for women – with a clear focus on social and environmental criteria.

This means we don’t just invest sustainably; we pay particular attention to gender equality and diversity in leadership, fair wages and working conditions, human rights, business ethics, and social impact. In short: your money doesn’t only work for returns – it also works for your values.

Everything included – even your tax statement

Many providers charge up to CHF 500 for a tax statement. With us, it’s included. You’ll automatically receive it at the beginning of the year for your tax return. The value of your investment is updated daily in the app.

Personal support, not a chatbot

At ellexx, you’re not just a number. Our team, together with Hypothekarbank Lenzburg AG, is personally here for you. No chatbot – just real, human support.

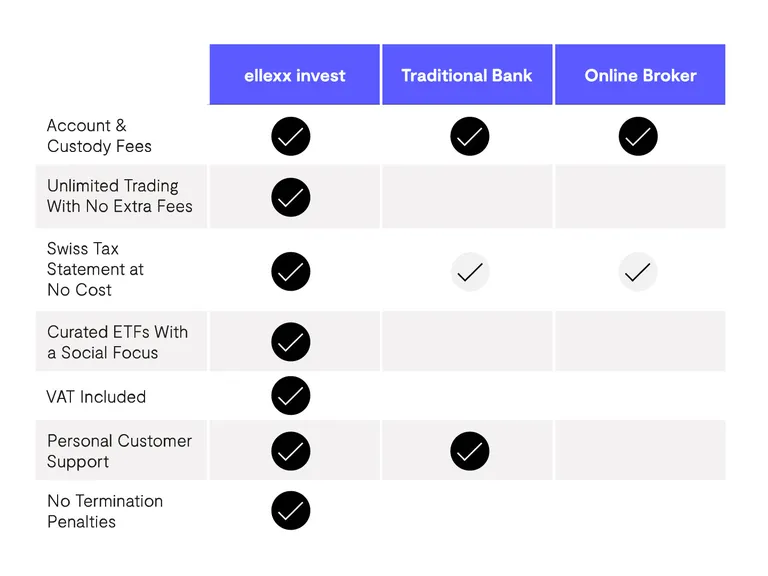

The ellexx Flat Fee in Comparison

Transparency Matters to Us

In addition to the flat fee, the ETF product costs (TER) and external charges such as stamp duty, exchange fees, and any applicable currency conversion fees apply. By selecting low-cost ETFs and securing fair conditions with our partner, Hypothekarbank Lenzburg AG, we ensure that these costs remain as low as possible:

Product costs per savings plan: 0.26% to 0.33%

We rely on low-cost ETFs that meet sustainability standards while representing companies and sectors that contribute to a more responsible economy. Some of these ETFs – as well as certain asset classes, such as real estate – are slightly more expensive than classic standard products. Overall, the product costs of our savings plans range from 0.26% to 0.33% per year – a fair price for a well-diversified and future-oriented investment strategy.

Stamp duties: 0.075% to 0.15% per transaction

In Switzerland, a so-called stamp duty is charged when buying or selling ETFs. It goes to the Federal Tax Administration and is automatically collected by our partner, Hypothekarbank Lenzburg AG. The rate depends on the fund’s domicile: 0.075% for ETFs domiciled in Switzerland and 0.15% for ETFs domiciled abroad. You can see where your ETF is domiciled in its factsheet – directly linked in the ellexx app.

Exchange fees: CHF 0.05 per trade

Exchange fees are incurred when buying or selling ETFs through a trading platform. They cover the costs associated with executing trades on the exchange and are charged directly by our partner, Hypothekarbank Lenzburg AG. Thanks to excellent conditions with our partner and the trade sponsoring provided by our product partner Swisscanto, each trade costs between CHF 0 and a maximum of CHF 0.05.

Currency conversion surcharge: approx. 0.25% per transaction

Since most ETFs at ellexx are currency-hedged, you usually don’t incur direct currency conversion fees. The ETF itself handles the protection against currency fluctuations, and the associated costs are already included in the ETF’s product costs (TER). However, a few ETFs (Emerging Markets, Crypto, and Small Caps) are not available in a hedged version, and those do incur currency conversion fees.

This fee covers the costs of converting currencies and is automatically charged by our partner, Hypothekarbank Lenzburg AG, when buying or selling the ETF. With our solution, the average currency conversion surcharge is around 0.25%. Compared with other providers, who typically charge around 1.5%, our surcharge is very low — allowing them to extract additional margin from offers that appear cheap at first glance.

FAQ

What sets ellexx ETF savings plans apart from traditional ETF products?

Our savings plans are curated by women, for women – with a consistent focus on social criteria. This means we don’t just invest sustainably; we place particular emphasis on:

- gender equality and diversity in management

- fair wages and working conditions

- the protection of human rights

- business ethics and social impact

In short: your money doesn’t just work for returns – it also works for your values.

What else does ellexx invest offer?

- Accessible: Start investing with small amounts – fully digital and without barriers. With ellexx invest, you can begin with as little as CHF 1,500.

- Understandable: What others make complicated is intuitive with us – and always at eye level.

- Meaningful: For you and your values – ETFs with a social focus.

- Fair: A transparent flat fee with no hidden costs. With ellexx invest, investing is worthwhile even with small monthly amounts, because we don’t charge additional trading fees. Compared to traditional banks, you benefit from significantly lower fees and access to low-cost ETFs.

- Supportive: ellexx accompanies you with knowledge, community, and exchange. Build comprehensive investing knowledge through our learning content and ask all your questions to our experts and the ellexx community.

Does it make a difference at ellexx invest if I invest monthly or less frequently?

No, we’ve intentionally chosen a flat fee – which means it makes little difference whether you invest smaller amounts regularly or make larger contributions less often. This is because we don’t charge any additional trading fees, neither when buying nor when selling. It’s important to us that investing is worthwhile even with small amounts and that you benefit from investing regularly over the long term.

We do recommend monthly investing, because regular contributions allow you to invest automatically and calmly over time – regardless of whether the market is high or low. This reduces your risk and helps you build wealth consistently, without having to worry about finding the perfect moment to invest.

What is an ETF savings plan?

An ETF savings plan is a simple and cost-effective way to invest regularly. You choose your investment strategy, set a monthly amount – and everything else runs automatically. This way, you build wealth step by step without having to worry about buying or selling all the time. In a sense, you’re automating discipline.

What are the benefits of a savings plan?

With a savings plan, you invest automatically and regularly – regardless of whether markets are rising or falling. This smooths out the entry price of your investments (the cost-average effect) and helps you avoid emotional decisions. Savings plans are therefore well suited even in turbulent market phases. You also stay invested over the long term and benefit fully from the power of compound interest.