We're now soon into the fourth year after the first Covid wave, in the midst of a global inflation. Times could be better for all of us, especially when it comes to our bank balances. Still, taking care of your finances is important. Especially now, and especially if you're a woman. Not only do women consider inflation and its consequences to be more serious, they are also more affected by its effects.

If you – like quite a few of the ellexx team, by the way – are one of those who have ignored this topic for too long and now finally want to tackle it: We'll show you which first steps are important for a 10/10 financial plan. The beauty of it: Once you've built a solid framework, the rest will be easy – and maybe even fun. We promise.

What is a financial plan anyway, and why do I need one?

Financial and savings plans are as individual as life itself. In principle, the first step of your financial planning is therefore something like a «Milchbüechli» calculation, as we say here in Switzerland: You get an overview of your most important expenses and income, look at what is left at the end and decide what you want to do with this money. But above all, it's important to have a financial plan because it helps you define your savings goals – and achieve them in the end.

A well thought out financial plan gives you structure and the good feeling of having everything under control. And it helps you to see money as something enjoyable instead of a stress factor. Important: Of course, this only applies to those who are able to put money aside in the first place.

This all sounds a bit overwhelming? Understandable, but it doesn't have to be. We've summarized the most important first steps for you.

1. Get to know your spending patterns

In order to properly plan your finances, you first need to figure out what you're spending your money on in the first place. «Many people live on way too much and don't realize it. They then get irritated when there's nothing left to save at the end of the month», explains Bente Roth, independent financial planner and wealth manager*. Buy a little booklet to write down your spendings by hand, if that's your thing. Or create a simple Excel list. There are also countless apps now that you can use to list your expenses. The only thing that matters is that you're really meticulous about writing everything down. Do this for two months to get a comprehensive overview.

At the end of these two months, take a look at what you spend the most money on: That third T-shirt you'll never wear? For that coffee-to-go every morning? «Without knowing how much money you're really spending and how much is left over – or could be left over – you can't create a good budget,» Roth says. For example, if at the end of those two months you realize you're spending 200 francs on restaurant food, start there. Think about whether you really want to spend that much money on that. Or rather: Imagine what you could do with the money instead. «Even with 100 francs a month, you can theoretically start putting money aside for investing,» says Roth.

2. Create your budget – and stick to it

Here, the word «your» is very important. Your budget has to fit you and the reality of your life. To do that, it's imperative that you ask yourself the following questions and answer them honestly: What is important to me in life? Where do I want to go? And where am I willing to make sacrifices to achieve my goal? Yes, money can be a very emotional topic. But once you've done that work, the way is paved for your financial future.

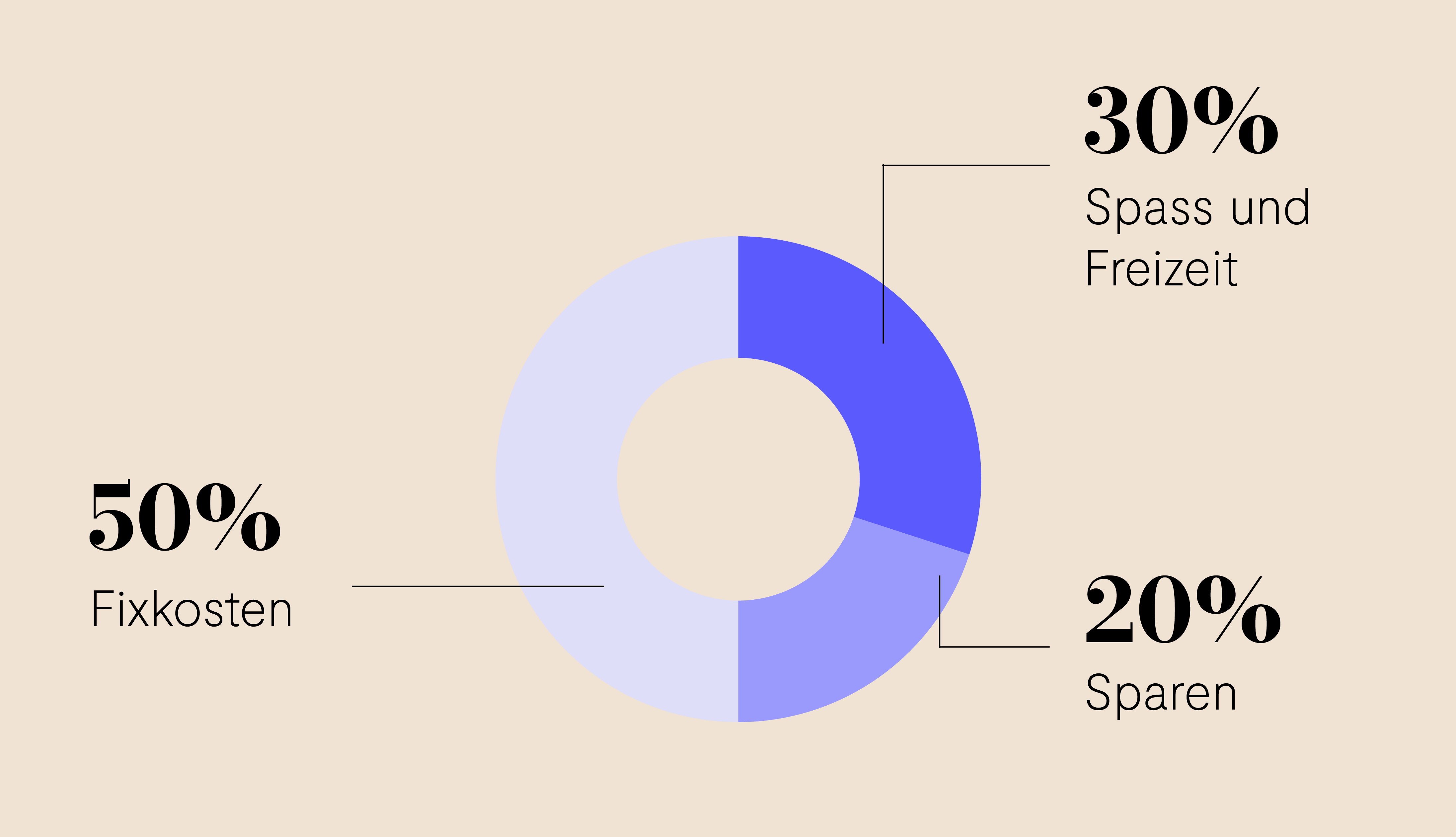

According to Bente Roth, a good budget consists of three pillars: Fixed costs (rent, electricity or other utilities, health insurance and reserves for taxes), money for fun and leisure, and money to save – or to pay off your debts first. But more on that later.

The 50-30-20 rule is a good approach for an initial draft budget, Roth explains, but it's not set in stone: «Every life is individual, so every budget has to be individualized.» Maybe you pay more rent because more home comforts are worth the money to you. Or you have an expensive hobby and cut back on food for it. Again, be honest with yourself and take a hard look at your lifestyle.

Bente Roth recommends setting up a standing order for certain items. For example, on the day your salary is transferred, you should transfer the monthly portion for taxes to a separate account: «Out of sight, out of mind. That way you can't spend the money on anything else in the first place.»

There's no point in loading the topic of money with more stress and bad feelings, Roth says: «You have to live life; it's over soon enough.» So explicitly allow yourself a «fun» section in your budget.

Once you've created your budget, here's the really hard part: you have to stick to it, or the best plan won't do you any good. Again, it can help to keep entering your expenses into an app to help you stay on track. U.S. author and entrepreneur Tori Dunlap recommends an additional method in her podcast: the «money date.» Sit down once a week and take charge of your finances. Create this evening lovingly, do something good for yourself, for example, cook your favorite meal beforehand. Taking care of your finances is also self-love.

On this Money Date, Dunlap says, take a hard look at your relationship with your money and ask yourself questions, as you would when taking stock with a romantic partner: Where do I feel comfortable? Where don't I? What could I do better? In terms of money, that might mean: Which expenses were justified, which were not? Why? Do I want to change that? And if so, how exactly? How could I use my money better?

3. Pay off your debts

Before you start saving, you should first pay off any debts, Roth explains: «That takes away the bad gut feeling, and you feel free. Before that, the relationship with money always means stress.» You may find yourself in the luxurious situation of being able to do both at the same time: pay off debt and save. Pretty sure that's not the case, though. So if you have outstanding credit card bills, for example, or orders that haven't been paid yet, start there. Now that you know how much money you might have left over each month, set a deadline for when you want – and can – reach that goal. Again, transfer the appropriate amount at the beginning of each month, and you won't even be tempted to spend the money. And Roth emphasizes: «Don't be afraid to plan for the long term. It's better to make a solid 3- or 5-year plan than not have one at all and be constantly plagued by stomachaches when you think about money.»

4. Define your savings goals

And be as specific as possible. «People are creatures of habit and like structure, even when it comes to finances,» Roth explains. The more specific your savings goal, the better you can plan the path to get there and the higher your motivation. A good place to start is your nest egg. A well-known rule of thumb is to have two months' salary on the high side: «This money is not meant for investing, you can leave it well in a savings account. But it's important to have a financial safe haven in case something happens,» Roth explains.

Maybe the thought of saving money to mend a broken washing machine someday isn't so sexy to you. Never mind. Your money, your mindset: think about situations where you might suddenly need money. Financial independence always means power and freedom. Having a nest egg in your bank account also gives you the ability to quit a job in a toxic environment, end an unhealthy relationship, or move out of an apartment that is constricting you.

Sinnvoll vorsorgen? Aber mit Rendite. Das geht. Wir sind überzeugt, dass ein verantwortungsbewusster Einsatz deines Geldes langfristig Wert schafft, ganz nach unserer Vision «Close the Gaps». Wenn du erwerbstätig bist, kannst du dich mit der elleXX 3a zusätzlich finanziell absichern, nachhaltig investieren und damit Steuern sparen.

Now that you know how much money you can put aside each month, base your savings plan on that amount. For example, if you can save 200 francs a month, calculate how long it will take for your nest egg to get fat enough. And, tried and true magic trick: Transfer this amount to an account on time when you receive your salary until your goal is reached. Yes, it can take discipline not to touch that money. That's why it's so important that you define the reason for this nest egg for yourself. If you know why you're saving this money, it will be easier for you. And we all need a little practice in the beginning.

5. Take care of your retirement planning

Now your debts are paid off and you know crystal clear what you want to save for. You've worked out a multi-year savings plan and are sticking to it. All is well. Now what? «One issue that often gets forgotten when saving is retirement planning», Roth says. Yes, it's inconvenient, but we have to acknowledge that the state pension in Switzerland is currently not enough for the vast majority of women to live on. The maximum AHV pension is less than 3,000 francs per month (and the recent vote on reform certainly did women no favors), so the money to live on comes from the second pillar. And – sorry to have to feed you this bitter pill – it's really important for you, especially as a woman, to take care of your own occupational pension provision as early as possible. Because the gender gap in the second pillar, i.e. the pension fund, is still almost 50 percent in Switzerland. Worse still, many women don't even have a second pillar.

But don't panic! You are now in a solid financial position and can help build up your pension. That's what the third pillar is for. Here you decide for yourself how much you can and want to pay in. The maximum amount you can pay into pillar 3a is 6883 francs per year. An amount that seems unattainable to you? Don't worry. «Every franc you pay in works for you,» Roth explains. So it makes sense to pay into the 3rd pillar even for smaller amounts. Of course, the money is gone for the time being, and you'll only get it back if you become self-employed, emigrate, buy a home or retire. But it will be worth it.

By the way, you can deduct the amount you have paid into your 3rd pillar by the end of the year from your taxes. And that's something to be happy about.

And what next?

You are now debt-free, have a nest egg in your savings account and feed your 3rd pillar monthly - one day maybe even annually with the maximum amount. Now you can start thinking about how and in what you want to invest, for example. You can read up on ETFs or think about how important sustainability is to you when investing. Or you can simply enjoy the fact that you are finally having fun with your finances.