A look at the numbers reveals a disparity: women and their ideas, as well as companies prioritizing equal opportunities, receive only a fraction of global investment flows:

- The world's largest companies, which attract the most investor money, are rarely led by women. Only 6.2% of companies in the American S&P 500 index are led by women, and the Swiss SMI index has none.

- Only about 5% of impact strategies prioritize gender equality, while a significant portion of funds goes to environmental sustainability goals.

- Across Europe, startups led by women receive only 2% of venture capital.

These statistics are reflected in the investment products available on the market. "When we founded ellexx in 2021, there wasn't a single gender equality-focused product among over 40,000 structured products in Switzerland," explains Patrizia Laeri, economist and co-founder of ellexx. "This is economically irrational as companies with more women at the top are proven to be more sustainable and successful."

Therefore, ellexx, in cooperation with Migros Bank, launched a Gender-Lens Investing (GLI) product. The goal is to strengthen social investing by directing more money, investments, and attention to companies and leaders who take equality seriously and actively promote it.

The ellexx Gender-Equality-Tracker Certificate Explained

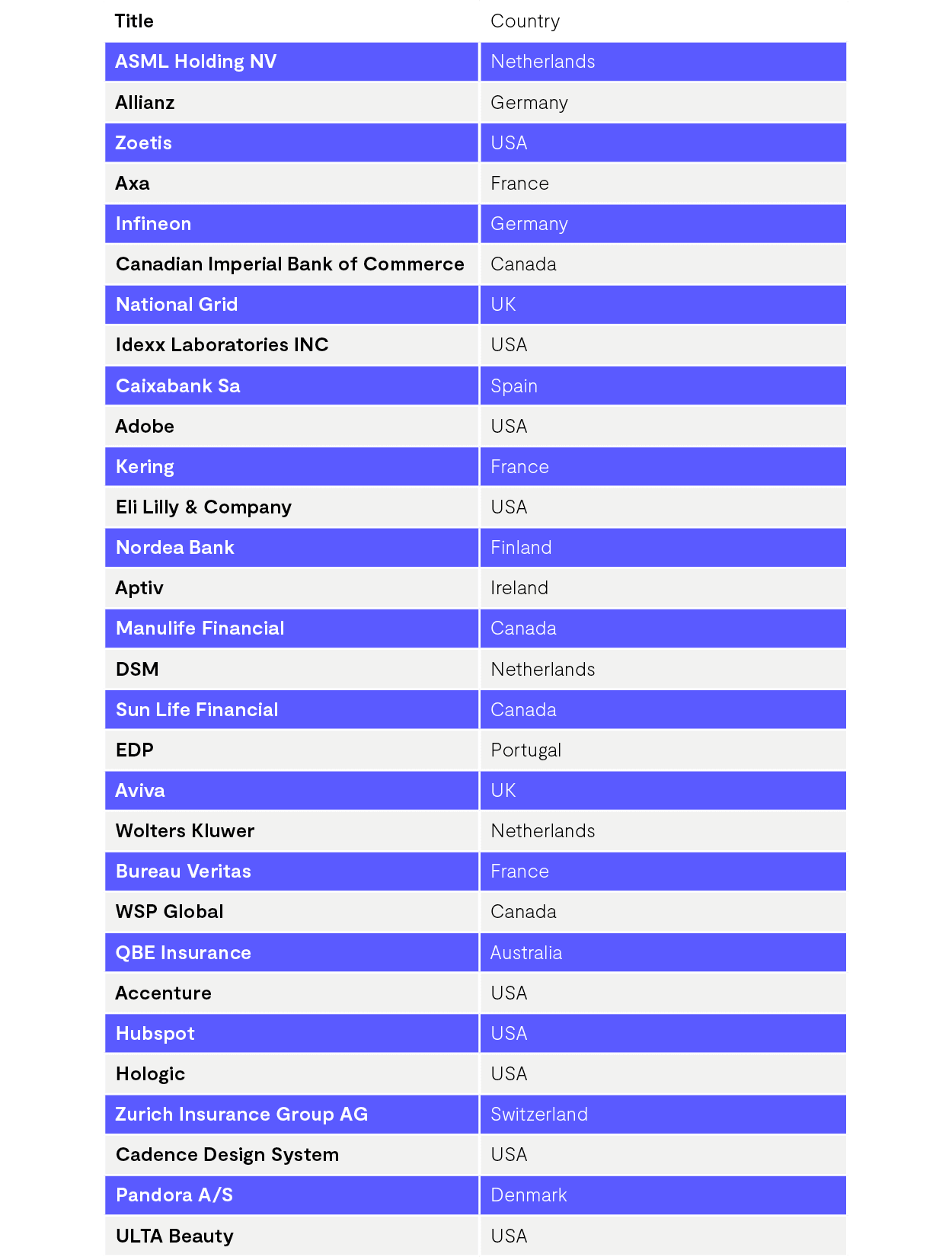

Together with our partner, Migros Bank, we created an innovative product for investors who care deeply about gender equality. With the ellexx Gender Equality Basket, investors can invest in 30 selected companies that take diversity and inclusion seriously. "For months, we filtered and researched women-friendly and sustainable companies with the Migros Bank team," recalls Patrizia Laeri.

Selection Criteria for the 30 Companies:

- Balanced Gender Ratio: This must be met at all levels. Gender diversity should be evident throughout the company, including in leadership positions.

- Equal Pay: Equal pay for equal work, regardless of gender.

- Family-Friendly Structures: Generous parental leave, flexible work models, and career support are important to allow both men and women to balance work and family responsibilities equally.

- Binding Policies Against Sexism: Mandatory rules against sexual harassment and enforcement bodies to implement these rules.

- Sustainability: Companies must commit to sustainable business practices and have an average AA ESG rating, with gender equality being an important part of it.

- Company Quality: The companies should not only excel in gender equality but also be outstanding in their business fields to ensure good returns.

Composition of the ellexx Stock Product

For company selection, ellexx uses a big-data approach, incorporating ratings from specialized organizations, research studies, media reports, and social media screenings. Employee evaluations are also crucial as they best understand the state of equality in their workplaces. "Since then, two other providers in Switzerland have launched similar gender-lens investing products," says Patrizia Laeri. "This is good because the more investors scrutinize where their money goes, the better."

Anyone who violates the criteria is immediately excluded

By the way, the composition of the companies is continuously reviewed - the so-called rebalancing takes place every three months. Patrizia Laeri explains: "If a company violates our investment philosophy, they are immediately excluded. We want to take action; otherwise, it has no impact."

The ellexx equity product is therefore a so-called actively managed structured product (in the form of a tracker certificate). This means that the Migros Bank fund management team actively manages the product and regularly ensures that all included companies comply with the stated criteria. Accordingly, the product's fees are at the usual level for actively managed investment products: the 1.1 percent fees also include hedging, which protects against the risk of currency differences with the Swiss franc.

Cost transparency is equally important to ellexx: Of the 1.1 percent fee, the issuer (the issuer of the product), Zürcher Kantonalbank, receives 0.3 percent. As a bank with a state guarantee, ZKB is a safe issuer for investors. The remaining 0.8 percent is evenly split between Migros Bank and ellexx. Therefore, we receive 0.4 percent for our cooperation with Migros Bank.

Since structured products are generally considered complex financial products, they are not typically suitable for beginners. The ellexx Gender Equality Basket is intended as a component in a diversified portfolio for those who specifically want to invest in equal opportunity companies.

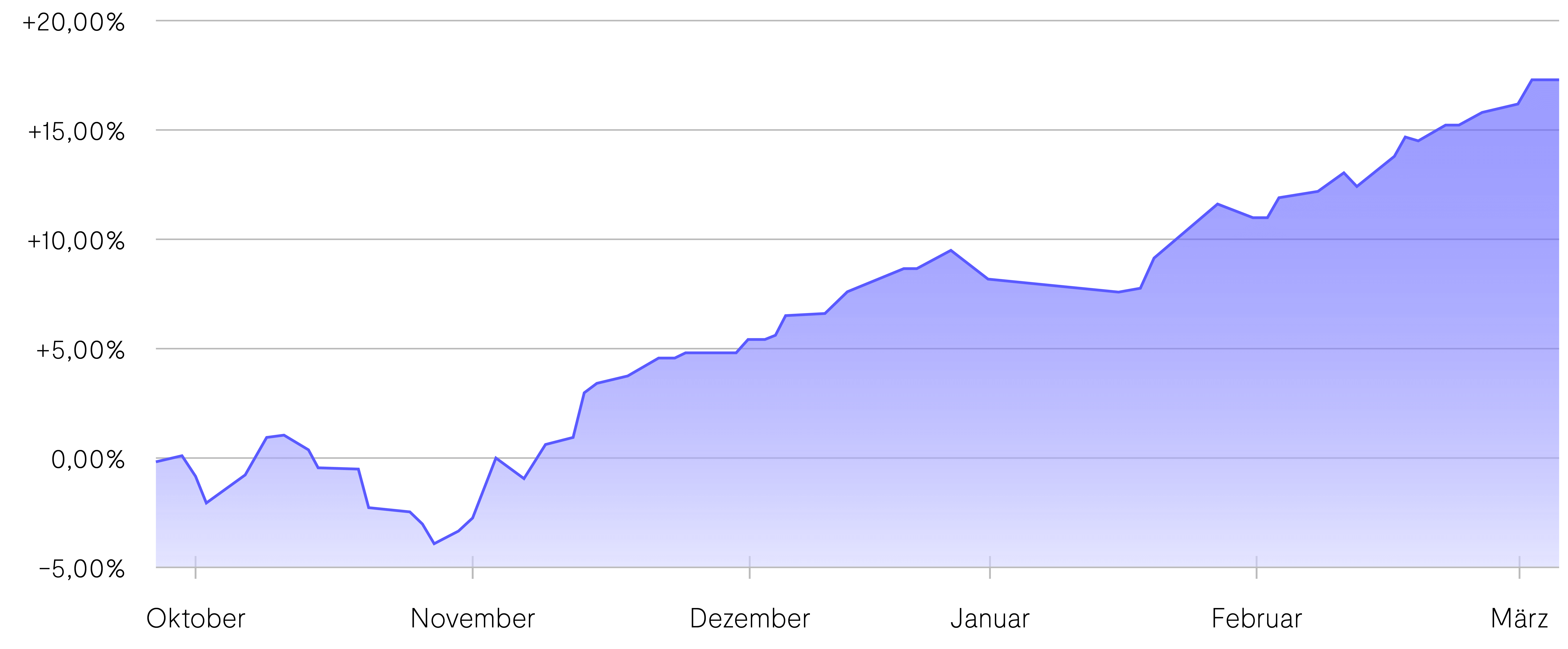

Poor performance during war years – but more successful in the long term

The ellexx equity product was initially criticized in the media because its performance was negative a few months after its launch. What happened? In February 2022, war broke out in Ukraine, leading to a generally poor year for the stock market. Financial products that favor environmentally friendly and socially responsible companies performed particularly poorly. For example, the MSCI World SRI Index, which includes companies with strong ESG performance, lost 22.1 percent in 2022. By contrast, the comparable MSCI Index without a focus on sustainability lost only 17.7 percent in the same year.

How can this be explained? Due to the war, companies in the fossil energy sector and arms manufacturing performed well—these are typically not included in ESG products. On the other hand, technology companies, which often lead in social responsibility, came under pressure due to the overall economic situation. However, in the long term, studies clearly show that companies with good environmental, social, and governance ratings perform better. Despite a rocky start, the ellexx equity product has also recovered well, gaining 17.3 percent in the last six months.

Performance of the ellexx equity product in the last six months

Become a Gender-Lens Investor

Interested investors can purchase the ellexx equity product through various channels:

- Through their home bank or an online broker: Those who already have a securities account with a bank or an online platform can add the ellexx equity product to their portfolio using the following ISIN: CH1105885698.

- Directly through ellexx's partner, Migros Bank: Migros Bank offers telephone consultations specifically about the product. To purchase the product through Migros Bank, you need an account and a securities account with them.

ellexx also offers independent financial advisory services, providing information on the risks of investment products and assessing whether the product fits one's investment strategy.